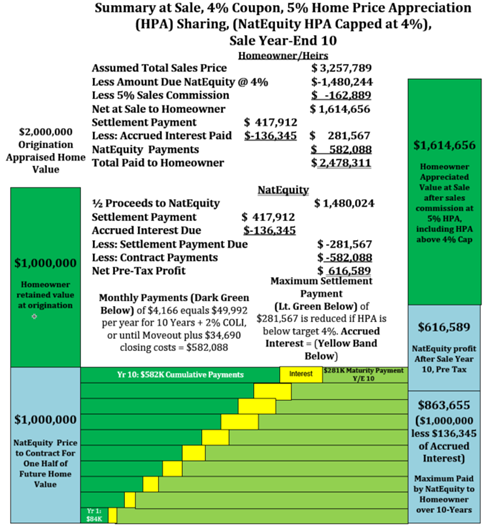

NatEquity agrees to buy one half of each home at today’s appraised value. When the home is sold, NatEquity shares in each home’s appreciated value. Typically, more than one half of each home’s future value is protected for heirs. In exchange the homeowner receives upfront money for a “fresh start” and cost of living adjust monthly income for as long as they live in the home. Along the way they have the assurance NatEquity is there to help when unexpected needs arise.

NatEquity pays the homeowner one half of the home’s current value in the form of monthly payments, advances for home improvement and a settlement payment when the home is sold. The unpledged portion of the homes future value is protected for heirs. NatEquity caps its share of cumulative compound share of HPA at 4%, in exchange for investor downside protections. In a typical coastal California single family suburban home this means NatEquity receives 35% of the sales proceeds, with the balance going to the homeowner or heirs.

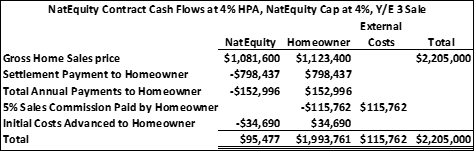

The example below is for a typical single-family home with a fair market value of $2,000,000 and provides initial $4,166 per month cash payment. The NatEquity contract is a balance of income certainty for homeowners and certainty of inheritance for heirs. Two charts follow showing examples of a sale after year 3 and year 10.